Competitiveness: Industry is lost in translation

The competitiveness problems and the operating costs in Greek industry-Which was the industry benefit from the reduction in wage costs?

By Vasilis Vasilopoulos

In the name of competitiveness, implemented policies that result in accounting illustrations, charges in production costs and ultimately in asphyxiation created in Greek industries.

So far the stabilization program implemented by the troika has recorded many failures, mainly regarding the fundamentals of Greek economy.

None of the competitiveness support policies, which fit the requirements of lenders and implemented by the government, helped to the reform of the Greek industry.

What is the problem?

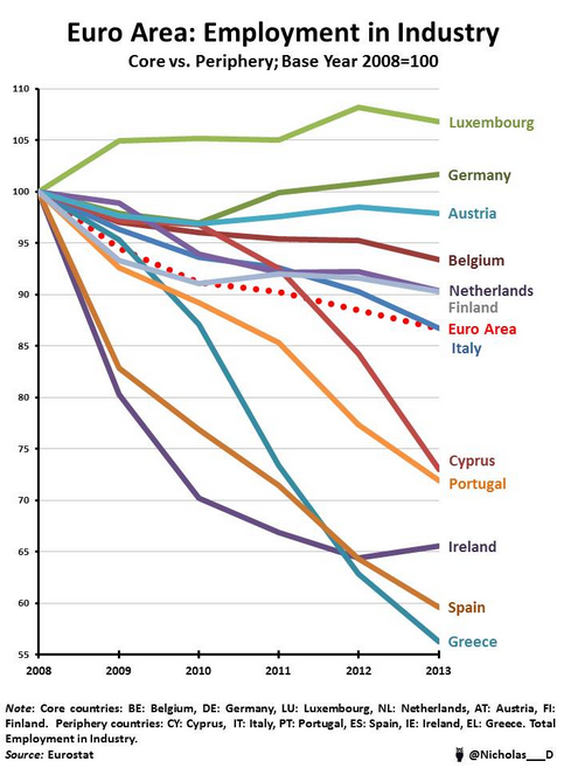

Today a labor intensive industry can not state that has effectively benefited from the reduction of labor costs (wage cuts and definition bottom).

For example if the wage bill reaches 30%, the reduction of 30% of these costs, from the memorandum policies, produces 9% cost reduction for the company.

However, there are other costly parameters, which invalidate the relief from wage cuts but also burden the overall cost of production.

The case of energy costs are among the most important. Today an industry that uses medium voltage, pays approximately 60% higher invoice to PPC compared to 2009. The paradox is that there is not a significant increase in the price per kWh, but there is big increase of other charges. Some of them are obvious and relate to RES and the cost of penalties for pollutants from lignite.

If the energy costs was reaching 30% in the production process, with these increases reaches 40-45% and eliminates the any benefit from the reduction in labor costs.

Another factor that undermines the Greek industry is the lack of liquidity. The funds from banks is scarce, so that businesses are forced to downsize the production process, since they are first seeking the supply of raw materials and meet the payroll.

Specifically, if today is a prerequisite for an industry, to prepay the raw material, this means that it will have to do it with cash, without accounting the bank liquidity. At the same time, does not receive from the state the VAT return (delays ranging from 1-3 years). On the contrary, are burdened by increased taxation including ENFIA. Even worse for industries of 4th zone and especially in national sensitive and remote areas, the amounts of OAED that were given as a bonus to cover the wage bill, which is estimated by industries in their operational plans (draft budget), are not paid since 2010.

In this suffocating context, the new settings that compensate of the return of VAT and of income tax, with the debts to social security funds, do not include the subsidies of Employment Agency. The contributions are much larger (perhaps this is the explanation to even greater reduction of wage of employees of the companies and of course of the uninsured work).

Of course, companies can deposit as guarantee the certified VAT reimbursement in a bank and to receive up to 100% of the amount. This does not apply though for requirements that are not attested, such as the Employment Agency.

The vicious cycle that has been created, shows how problematic can be the recovery of the Greek industry.

For example, if there is no progress in causing an investment shock through a public development bank, there will be no treatment with minor accounting corrections.

Seeing things in terms of workers in the industry, it is clear that only this productive activity may increase employment.

In any case, the industrial policy of the two poles of the political leadership is clear that it will soon become one of the key issues in the public sphere as it is the only source that can generate wealth and absorb unemployment.

Sources: Ministry of Development, Eurostat, OECD