Bank of Greece: At 6.38 billion the capital needs of banks

The Bank of Greece reported the capital needs of Greek banks on BlackRock’s essay. They were shaped at 6.38 billion euros, while a reasonable term was given, in order to allow the Banks to cover the capital gap.

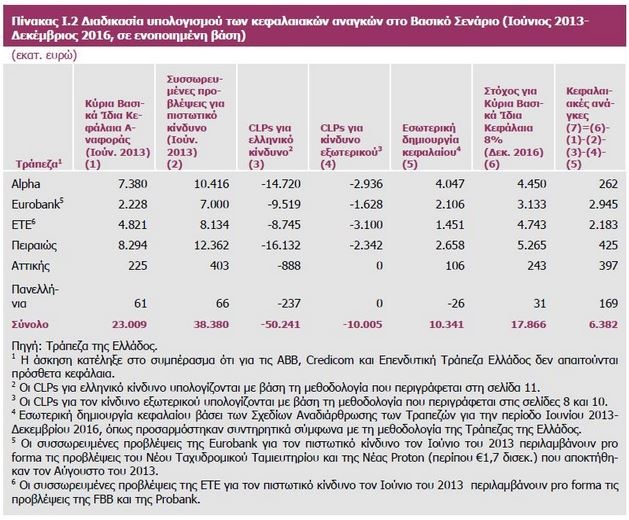

Under BlackRock’s essay about Greek economy, the Bank of Greece stated that Eurobank’s capital needs are at 2.94 billion euros, Ethniki’s at 2.18 billion euros, Piraeus’ at 425 million euros and Alpha’s at 262 million. Also the capital needs of Attica amount to 397 million euros and the Panellinias at 169 million.

The Bank of Greece believes that in normal economic uncertainty, the estimated capital needs for the period, June 2013-December 2016, are covered by security stocks, which have already incorporated in limiting effects of capital needs, as the private sector participation in future share capital increases, the recognition of deferred taxation, sale of assets and others. Also from the funds of TXS, which haven’t been used.

In addition, the Bank of Greece asked banks to submit, not later than 15 April 2014, a plan for capital enhancement based on the results with a timetable for implementation as soon as possible. Bank of Greece’s estimations for the loans in a depth of three years seem interesting, because they could affect the capital adequacy.

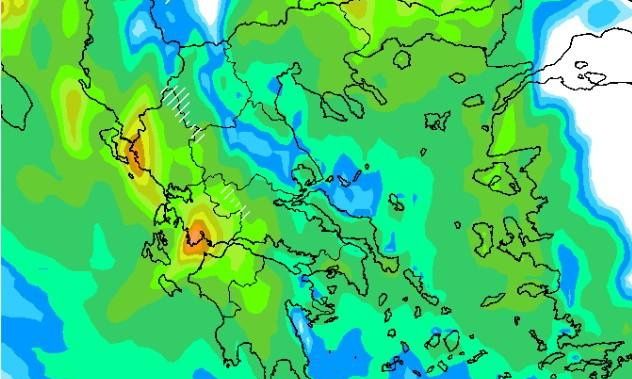

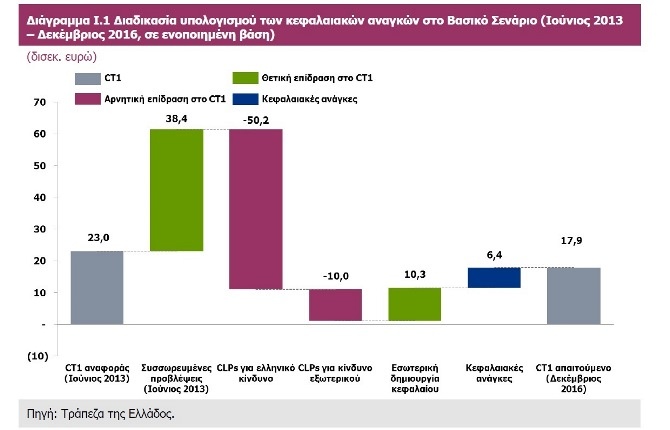

As you can see in the above table, the total estimated losses on loans for the period 2013-2016 are estimated at 50.241 billion euros for Greece and at 10.41 billion for foreign transactions. It’s a total of 60.7 billion against the existing provisions 38.328 billion. Recall the term is based on BlackRock’s data, which haven’t been published.