EUROSTAT: "We did not publish figures for surplus"

Revelation: Senior official of Eurostat reveals in NEWSBOMB that there is no mention of a surplus - Topic is confirmed by the Wall Street Journal - Yesterday's announcement by Eurostat show only the deficit, which estimated at around 16 billion Euros.

Many questions raised the clarification given by a senior of Eurostat and close associate of Chief Walter Rantermacher Luxembourg, during a conversation with NEWSBOMB.

Eurostat reveals that it was not the one that "publishes" - or - validate the primary surplus of Greece. As told to NEWSBOMB the senior executive Eurostat, the surplus was announced by the Directorate General for Economic and Financial Affairs which is part of the European Commission.

This means that Eurostat avoids to formally declare the word "validation" (verify) for the primary surplus, as the above statement implies an agreement only between the European Commission, the IMF and the European Central Bank without the involvement of Eurostat.

But why Eurostat disclaims any engagement so far in validating the primary surplus?

Why the Greek Government gave to the media a notice for the confirmation of the surplus, which does not appear anywhere the 3.4 billion surplus?

Why the office of Mr. Rantermacher, for any comment on the primary surplus of Greece, referes to the institution of the European Commission, and Eurostat keeps discreet distance from the whole affair showing that he does not want to get involved?

It is obvious that something is wrong, which we first revealed in NEWSBOMB from yesterday morning with exclusive reports and titled "Panic for the primary surplus of 3.4 billion Euros."

In the article we mentioned in detail that "numbers won't add up, as all economists are trying to find out how we got this number. If someone tries to calculate the primary surplus of 3.4 billion Euros, then he will get lost in estimates and assumptions... between Eurostat and ELSTAT. As much as one tries to make sense, in the end 900 million Euros are missing from the 3.4!" Read the whole yesterday's article of NEWSBOMB here.

It seems that there is a complicated background, which sooner or later will unfold as the official stance of Eurostat raises many questions so far...

THERE IS NO PRIMARY SURPLUS TO THE NOTICE OF EUROSTAT

A careful look at the yesterday's announcement by Eurostat, which distributed in all media, shows that there is nowhere any reference whatsoever to primary surplus! Quite the contrary, the notice states the shortfall originally estimated at 23 billion Euros, of which deducting interest payments falls to 16 billion Euros!

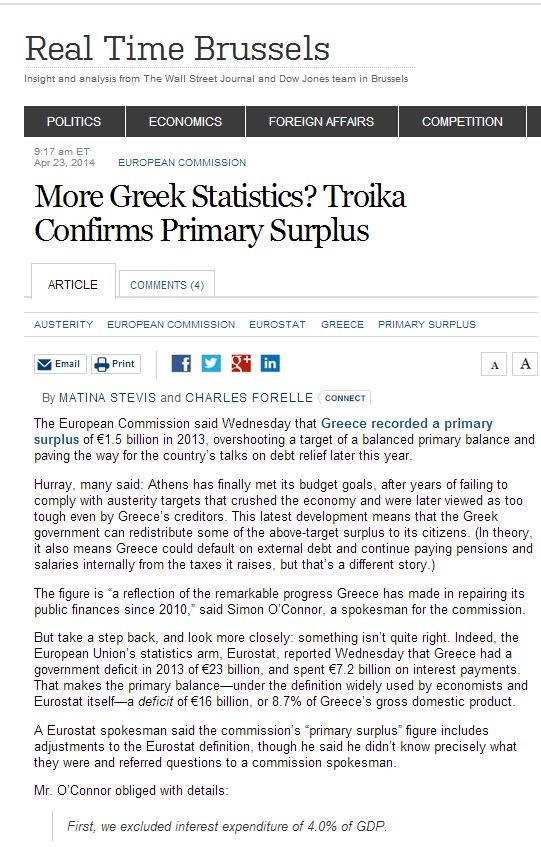

The subject is pointed in an article of the Wall Street Journal in which challenges the surplus, but also the manipulations of the European Commission and the Greek side.

"Hurray, many said", says the WSJ and continues: "Athens has finally met its budget goals, after years of failing to comply with austerity targets that crushed the economy and were later viewed as too tough even by Greece's creditors."

In fact, the newspaper encourages everyone to look a little more closely at the numbers indicating that: "Eurostat reported on Wednesday that Greece had a government deficit in 2013 of €23 billion, and spent €7.2 billion on interest payments. That makes the primary balance—under the definition widely used by economists and Eurostat itself—a deficit of €16 billion, or 8.7% of Greece's gross domestic product".

Read here the article in the WSJ.

The newspaper adds that a representative of Eurostat analyzed how the primary surplus of the size of the European Commission includes adjustments to the definition, however without he knowing what exactly these changes are.

However, he referred the journalists to the representative of the European Commission, Simon O'Connor.

Who, in turn, gave the details:

"First, we excluded the interest charges of around 4 % of GDP." This, explains the Wall Street Journal, is in line with the general definition of the primary surplus.

"Second, we exclude several specific items, mainly to better reflect the underlying structural fiscal position. In 2013, these adjustments amounted to 9.5% of GDP, mainly reflecting the one-off cost of the support to the banking sector, which amounted to 10.8% of GDP according to the programme definition, and the transfers from Member States to Greece corresponding to profits on Greek Bonds held by the Euro-system Central Banks, which amounted to 1.5% of GDP.

This brings us to a primary surplus of 0.8% of GDP," adds O'Connor.

When asked if this methodology is applied to another EU member country, the representative of the European Commission responded to the WSJ: "No, the definition is country-specific."

In other words, Mr. O'Connor admits that they count surplus however they like!